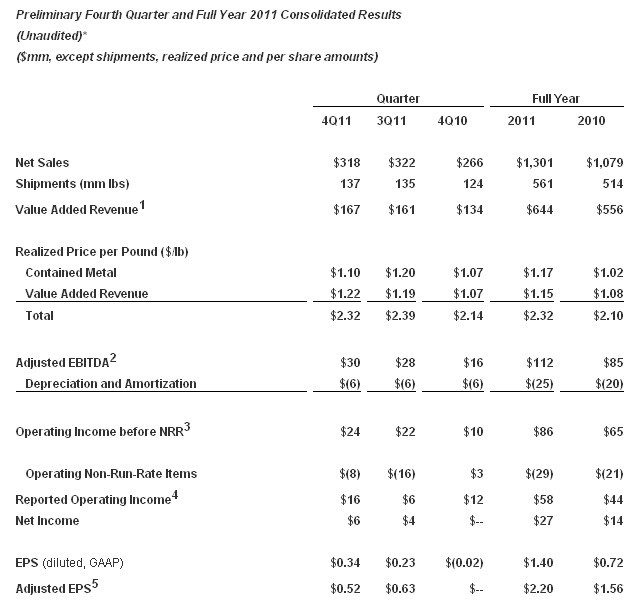

Kaiser Aluminum Corporation (Nasdaq:KALU - News) today reported preliminary, unaudited net income of $27 million or $1.40 earnings per diluted share for the full year 2011 compared to $14 million, or $0.72 per diluted share for the full year 2010. Excluding the impact of non-run-rate items, adjusted net income was $42 million or $2.20 per diluted share for the year ended 2011, compared to adjusted net income of $30 million or $1.56 per diluted share in the prior year.

Value added revenue of $644 million increased $88 million or 16% from the prior year, reflecting strong demand for aerospace and automotive applications and strong performance from the acquired Alexco and Nichols Wire businesses. Adjusted consolidated EBITDA of $112 million or 17% of value added revenue reflected significant year-over-year improvement compared to adjusted consolidated EBITDA of $85 million or 15% of value added revenue for the year ended 2010.

Summary

"We are pleased with solid year-over-year improvement and strong 2011 results," said Jack A. Hockema, President, CEO and Chairman. "Our aerospace and automotive applications achieved record value added revenue. In addition, stronger demand and shipments across our end use categories led to significant improvement in our adjusted EBITDA and our EBITDA margin. We continued to invest in our growth platform commencing capacity expansions for our aerospace extruded products and heat treat plate that will come on stream later this year and in 2013. We also have made good progress in the ramp up of our Kalamazoo rod and bar facility. Although the ramp up has been slower than anticipated, as a low cost producer for these products the Kalamazoo facility is expected to fully achieve its investment potential over the longer-term."

"As we look forward, we expect robust aerospace demand to continue in 2012 and anticipate steady improvement in automotive and general industrial demand. Importantly, we are well-positioned to capitalize on this increasing demand and to realize the potential of the sizable, strategic investments we have made in our business. In addition, our solid balance sheet and enhanced financial flexibility due in part due to a larger and more favorable revolving credit facility allow us to continue to pursue other organic and acquisition growth opportunities," concluded Mr. Hockema.

1 Value added revenue is a non-GAAP measure equal to Fabricated Products net sales less hedged cost of alloyed metal

2 Adjusted EBITDA is a non-GAAP measure equal to Operating Income (before non-run-rate items) plus depreciation and amortization

3 NRR = Non-run-rate

4 Totals may not sum due to rounding

5 Adjusted EPS is a non-GAAP measure equal to estimated EPS excluding Total NRR items (net of tax)

* Please refer to GAAP financial statements

Consolidated operating income excluding the impact of non-run-rate items was $24 million for the fourth quarter 2011, compared to $22 million for the third quarter and more than double the fourth quarter 2010, driven by stronger demand and shipments across end market uses. Preliminary consolidated operating income as reported in the fourth quarter 2011 included approximately $5 million of non-cash, mark-to-market losses on metal hedging positions due to a decline in underlying metal.

For the full year 2011, consolidated operating income excluding the impact of non-run-rate items was $86 million, up 33% compared to $65 million for the year ended 2010. Preliminary consolidated operating income as reported for the year ended 2011 of $58 million included approximately $29 million of non-cash, non-run-rate items primarily related to mark-to-market losses on metal hedging positions.

Cash flow in 2011 remained strong as adjusted consolidated EBITDA funded cash requirements for operations and internal growth. Capital spending during the year was approximately $31 million as the Company commenced capacity expansions of its Alexco and Trentwood facilities to meet growing aerospace demand and funded other capital projects to improve quality and efficiency throughout its manufacturing platform. The Company's balance sheet remained strong, and total liquidity at December 31, 2011 was in excess of $300 million, including cash of $50 million and borrowing availability under its revolving credit facility.

Outlook

"We remain very optimistic about the long-term growth opportunities for aerospace and high strength applications driven by increasing build rates, larger airframes, and monolithic design. We also anticipate further solid growth for our automotive applications as light vehicle build rates and aluminum extrusion content per vehicle both continue to increase. Demand for our general engineering applications reflects an ongoing, slow but steady economic recovery. Service center inventory for these applications remains at historically low levels, however we do not anticipate significant restocking until the industrial economy demonstrates stronger and more consistent growth," said Mr. Hockema.

"Overall, we anticipate that total value added revenue growth for the first half of 2012 will be driven by strong market demand for aerospace applications. In addition, value added revenue in the first half is anticipated to reflect improving demand and normal seasonal strength for our automotive and general engineering applications. With higher sales volume and improving manufacturing efficiencies, we expect continued growth in our consolidated adjusted EBITDA and EBITDA margin," concluded Mr. Hockema.

Preliminary Results Subject to Final Audit

Final audited results are subject to change pending the final year-end actuarial valuation of the union voluntary employee beneficiary association (VEBA) accumulated postretirement obligation as a result of additional information received from the VEBA administrators for the 2011 and 2010 years. If the final valuations are materially different from those reflected in the preliminary 2011 full year and/or reported prior period financial statements, it is possible that the Company will have adjustments affecting the 2011 full year and/or prior periods.

VEBA-related income or expense is non-cash and considered a non-run-rate item. Accordingly, any VEBA-related change to income in any period will have no impact to the Company's adjusted (excluding non-run-rate items) consolidated operating income, EBITDA, net income or EPS.

Conference Call

Kaiser Aluminum Corporation will host a conference call on February 16, 2012, at 10:00am (Pacific Time); 12:00pm (Central Time); 1:00pm (Eastern Time), to discuss fourth quarter and full year 2011 results. To participate, the conference call can be directly accessed from the U.S. and Canada at (888) 539-3679, and accessed internationally at (719) 325-2418. A link to the simultaneous webcast can be accessed on the Company's website at http://investors.kaiseraluminum.com/events.cfm. A copy of a presentation will be available for download prior to the call and an audio archive will be available on the Company's website following the call.

Company Description

Kaiser Aluminum Corporation, headquartered in Foothill Ranch, Calif., is a leading producer of semi-fabricated specialty aluminum products, serving customers worldwide with highly-engineered solutions for aerospace and high-strength, general engineering, and custom automotive and industrial applications. The Company's North American facilities produce value-added sheet, plate, extrusions, rod, bar, tube and wire products, adhering to traditions of quality, innovation and service that have been key components of our culture since the Company was founded in 1946. The Company's stock is included in the Russell 2000(R) index and the S&P Small Cap 600(R) index.

The Kaiser Aluminum Corporation logo is available at http://www.globenewswire.com/newsroom/prs/?pkgid=6081

Available Information

For more information, please visit the Company's website at www.kaiseraluminum.com. The website includes a section for investor relations under which the Company provides notifications of news or announcements regarding its financial performance, including Securities and Exchange Commission (SEC) filings, investor events, and earnings and other press releases. In addition, all Company filings submitted to the SEC are available through a link to the section of the SEC's website at www.sec.gov which includes: Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and Proxy Statements for the Company's annual stockholders' meetings and other information statements as filed with the SEC. In addition, the Company provides a webcast of its quarterly earnings calls and certain events in which management participates or hosts with members of the investment community.

Non-GAAP Financial Measures

This earnings release contains certain non-GAAP financial measures. A "non-GAAP financial measure" is defined as a numerical measure of a company's financial performance that excludes or includes amounts so as to be different than the most directly comparable measure calculated and presented in accordance with GAAP in the statements of income, balance sheets or statements of cash flow of the company. Pursuant to the requirements of Regulation G, the Company has provided a reconciliation of non-GAAP financial measures to the most directly comparable financial measure in the accompanying tables.

The non-GAAP financial measures used within this earnings release are operating income, EBITDA, net income and earnings per diluted share, in each case excluding non-run-rate items. These measures are presented because management uses this information to monitor and evaluate financial results and trends and believes this information to also be useful for investors.

Forward-Looking Statements

This press release contains statements based on management's current expectations, estimates and projections that constitute "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995 involving known and unknown risks and uncertainties that may cause actual results, performance or achievements of the Company to be materially different from those expressed or implied. Kaiser Aluminum cautions that such forward-looking statements are not guarantees of future performance or events and involve significant risks and uncertainties and actual events may vary materially from those expressed or implied in the forward-looking statements as a result of various factors. These factors include: (a) material adverse changes in economic or industry conditions generally, including global financial markets; (b) the Company's inability to achieve the level of growth or other benefits anticipated by management, including those anticipated from the Company's acquisitions and other strategic investments and the integration of acquired businesses; (c) increases in the Company's costs, including the cost of energy, raw materials and freight costs, which the Company is unable to pass through to its customers; (d) pressure to reduce defense spending and demand for the Company's products used in defense applications as the U.S. and other governments are faced with competing national priorities; (e) changes in the markets served by the Company, including aerospace, defense, general engineering, automotive, distribution and other markets, including changes impacting the volume, price or mix of products sold by the Company and the Company's ability to flex production consistent with changing demand levels; (f) the Company's ability to lower energy costs, realize manufacturing efficiencies and complete its expansion and organic growth projects, equipment and facility upgrades to improve manufacturing and cost efficiencies and product expansions as planned and by targeted completion dates; (g) unfavorable changes in laws or regulations that impact the Company's operations and results; (h) the outcome of contingencies, including legal proceedings, government investigations and environmental remediation; (i) changes in accounting that affect the Company's reported earnings, operating income or results; and (j) other risk factors summarized in the Company's reports filed with the SEC, including the Company's most recent Annual Report on Form 10-K. As more fully described in these reports, "non-run-rate" items are items that, while they may occur from period to period, are particularly material to results, impact costs primarily as a result of external market factors and may not occur in future periods if the same level of underlying performance were to occur. All information in this release is as of the date of the release. The Company undertakes no duty to update any forward-looking statement to conform the statement to actual results or changes in the Company's expectations.

Without limiting the generality of the foregoing, the Company cautions that results for the fourth quarter and full year ended 2011 contained in this press release are preliminary in nature and that statements in this press release including such results constitute forward-looking statements involving uncertainties that could cause such results, when final and set forth in the Company's Annual Report on Form 10-K for the year ended December 31, 2011, to vary, perhaps materially, from those contained in this press release. The factors that may cause final results to vary from the preliminary results contained in this press release include, among others, (i) the completion of the audit of the financial statements as of and for the year ended December 31, 2011 and (ii) the completion of the valuation of postretirement obligations of the VEBA.