Global aluminium production surged to an all-time high of 116,180 tonnes per day in February, according to figures released this morning by the International Aluminium Institute (IAI).

Annualised production jumped by 2.15 million tonnes to 42.41 million tonnes last month, eclipsing the previous high of 41.64 million tonnes recorded in June 2010.

The strength of production growth this year may not completely negate the light metal’s evolving bull narrative but it will place a cap on just how far prices can move on the upside.

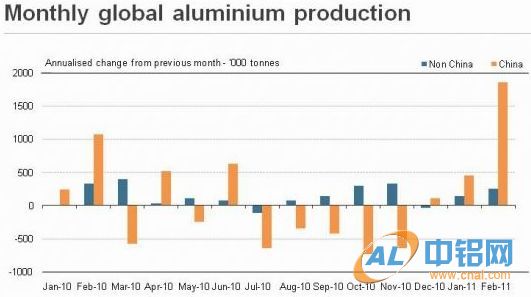

China was the main reason for that massive month-on-month increase in February. The country’s annualised production soared by 1.88 million tonnes to 17.00 million tonnes.

National production is now almost back to previous peak run-rates recorded in the middle of last year before the collective gearing-down to meet Beijing’s energy efficiency targets ahead of the December expiry of the old five-year plan.

Chinese smelters cumulatively reduced output by 2.65 million tonnes annualised in the second half of last year. It was always likely that they would restart idled lines just as soon as they could, but the power crunch in parts of the country during the winter months of December and January acted as a restraining influence.

No such worries in February, it seems, given the sheer scale of the collective reactivation and consequent ramp-up in national output. The speed of the turnaround and the now open question as to how much more capacity, both idled and new, might come on stream in the coming months, undermines one of the themes in the bull script for aluminum. Low production rates coupled with still-robust usage growth in China in the tail end of 2010 fed an assumption that the local market was in supply-demand deficit.

That deficit was expected to persist and possibly widen this year. It was a view articulated by Alcoa in a January conference call with analysts. The U.S. producer said it expected the Chinese market to register a 700,000-tonne deficit this year.

That in turn would imply a drawdown in stocks, first and foremost off-market stocks, and a potential shift in net trade towards more consistent and bigger imports. Alcoa’s forecast, which was by no means unique in the aluminium market, included the possibility of restarts and new capacity additions but not, it is hard to believe, on the scale and speed seen so far this year.

Production in the rest of the world, meanwhile, is also still rising, just as it has been since the second half of 2009. At 25.40 million tonnes annualised production outside of China in February was the highest it’s been since October 2008. That means that the greater part of the production cuts initiated during the Great Contraction of late 2008/early 2009 has now been negated.

Restarts have played some role in rising production. In North America Alcoa announced in January it was restarting around 200,000 tonnes of annual capacity, although it is still keeping 674,000 tonnes mothballed across its global smelter network. Smaller U.S. producer Ormet confirmed last week that it has restored idled lines and is now running its 266,000-tonne per year smelter at capacity.

The real driver of higher production in the non-Chinese world, however, is not restarts but new capacity, particularly in the Gulf region. Gulf production was 3.35 million tonnes annualised in February, up 44 percent from February 2010. That super-fast growth rate reflects the simultaneous commissioning of two new smelters, the 585,000-tonne per year Qatalum plant in Qatar and the 700,000-tonne per year EMAL plant in Abu Dhabi. Both could potentially double in capacity as a second-phase development. Alcoa’s Maaden joint venture in Saudi will bring another 740,000 tonnes of annual capacity to the region in 2013.

The concentration of new smelter capacity in the Gulf region is one of the reasons why aluminum has drawn price strength from the same turmoil in the Middle East that has unsettled the rest of the risk asset universe. It is unique among the LME metals in having such a direct supply-side link to the region. The other reason for aluminium becoming the defensive play of choice among the LME metals in recent days is down to its energy-intensive production process.

While higher oil prices pose a medium-term threat for demand of all metals, aluminium included, they also serve to raise the light metal’s cost curve. Indeed, there are many market participants who view aluminium as a hybrid metals-energy play, meaning that anything that pushes up energy prices will underpin aluminium as well.

This part of the bull narrative is unchanged. Continuing regional unrest, which has been ratcheted up another notch by the intervention of Western powers in Libya, is going to keep the spotlight both on Gulf smelters and on oil prices.

What has changed with the latest IAI figures, though, is the argument that China is heading into an extended period of deficit. February’s figures suggest that Chinese production is roaring back into action with the potential for further increases in the coming period. That will serve to remind everyone that there is a lot of spare capacity out there that can be reactivated at the right price.

In short, aluminium may not be going down in price any time soon. But it’s unlikely to go too much higher either. (Financial Post)