Alcoa (NYSE:AA) recently announced that it expects the global consumption and supply of aluminum to double from its 2010 levels by 2020. [1] This is based on the company’s forecast that aluminum demand will grow at a compounded average growth rate of 6.5% annually.

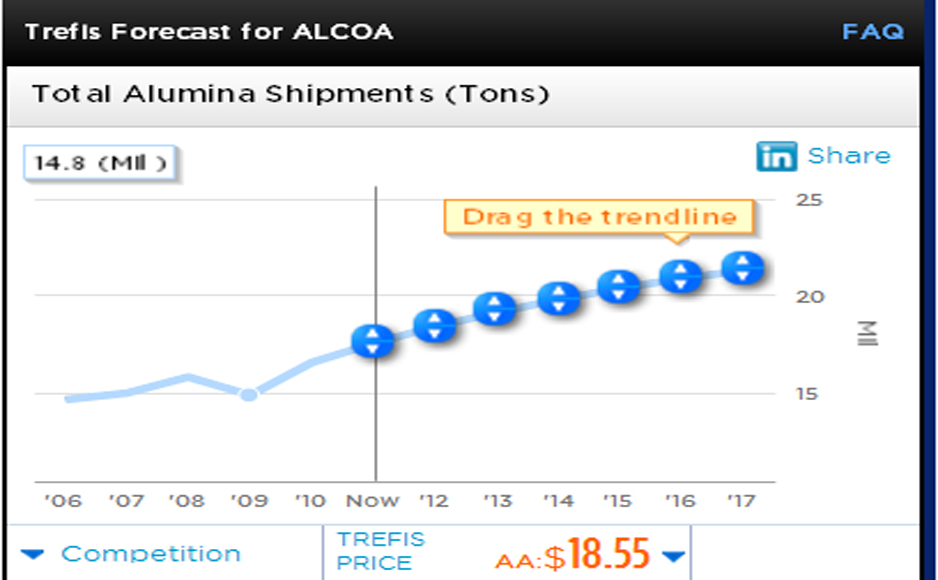

Here we look at the key trends that lend support to these growth estimates by the world leader in the production and management of primary aluminum, fabricated aluminum and alumina. We highlight that if growth estimates indeed surpass our base line forecasts, we see upside to our $18.55 price estimate for Alcoa and would imply a near 30% potential total return. Alcoa competes with other international metals and mining giants like Rusal, Rio Tinto (NYSE:RIO), BHP Billiton (NYSE:BHP) and Chalco (NYSE:ACH).

Rising Demand for Aluminum Driven by …

Aluminum is lightweight and using it in automobiles can help reduce vehicle weight and hence improve fuel efficiency. Moreover, lighter automobiles also mean lower emissions. The use of one kilogram of aluminum replacing heavier materials in a car or light truck can save a net 20 kg of CO2 over the life of the vehicle. Rising fuel prices and stringent environmental laws are expected to increase demand for aluminum as a replacement for iron.

The unique characteristics of aluminum being malleable and ductile helps in the fabrication, storage and distribution of retail products. Moreover, the fact that aluminum is readily recycled makes it a natural choice for making cans. The demand for aluminum from the packaging industry is already on the rise. You can read more about this in our article, Good Things Come in Aluminum Packages for Alcoa.

Aluminum is durable and its corrosion resistance ensures lower maintenance costs. As as result, the construction industry is finding more uses for aluminum with the growing need for “efficient infrastructure”.

Alcoa is Ready to Make the Most of This Trend

In our Alcoa analysis, we project a 2% growth in the company’s shipments of aluminum.

However, if the shipment figures also grow at the demand growth rate of 6.5% annually, then the primary metals division would ship more than 5.5 million tonnes over the next 5 years from its current level of just under 4 million tonnes. This scenario represents a 12% upside to our $18.55 price estimate and near 30% total potential upside.