Will we see aluminum prices suffer because of oversupply issues? Several analysts are saying no, and Harbor Aluminum’s recent conclusions on the topic point otherwise.

Sucden Financial recently released their quarterly base metals report, with a spotlight on aluminum, copper and tin activity. Brenda Sullivan, Sucden’s head of research, spoke with Reuters Insider reporters and underlined that both aluminum and copper are bucking their longer-term downtrends and moving upwards.

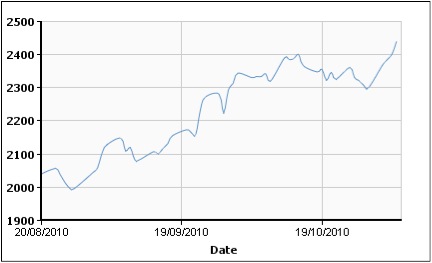

Aluminum and copper have both seen historic price increases in the wake of the Fed’s decision to buy up treasuries to the tune of $600 billion over the next several months. The aluminum cash price hit a high around $2,500 before the weekend.

Sucden is forecasting Q4 prices for aluminum to remain in the $2,000-$2,500 range.

Whether this remains a sustainable trend remains to be seen. Volatility has been higher, with spreads tightening, much of it due to supply-side issues. One reason aluminum’s price rise may be short-lived (or, at the very least, illogical) is that warehouse stockpiles are larger than producers would like them to be. According to an article in Aluminum Investing News, “the amount of aluminum stored in warehouses has climbed to a 32-year high. In the past year alone aluminum stocks have risen 25 percent, paradoxically futures prices are up 67 percent.” Between 2000 and 2009, aluminum demand grew 38 percent, compared to 20 percent across other metals. However, supply has outpaced demand by 6 million tons since 2007, said William Adams, an analyst for basemetals.com.

Going back into the world of ETFs for a moment, Steve Hardcastle, head of client services at JPMorgan Commodity ETF Services, seems to share the view of aluminum perhaps not making the most sense in the ETF market. “The aluminum fundamentals are by no means bullish,” he said in a Reuters report. “I cannot see that aluminum would be a particularly attractive investment for the ETC client base. It would be a very welcome introduction of somewhere else to park this surplus aluminum.”

But with global demand still pulsing (as opposed to domestic demand here in the US, what with the residential construction sector still sluggish) it may be hard to downplay the notion that aluminum prices have room to rise. In contrast to the above views, which downplay aluminum’s potential increases, Harbor Aluminum’s recent outlook seems more a rosy one.

Although we cannot republish these findings in detail, we can report that Harbor expects the developed world to do better than feared, and tightness in the scrap market and the launch of the new ETFs to buoy aluminum demand.